3 Simple Techniques For Offshore Business Formation

Table of ContentsRumored Buzz on Offshore Business FormationAn Unbiased View of Offshore Business FormationThe Definitive Guide to Offshore Business FormationOffshore Business Formation Things To Know Before You BuyThe Basic Principles Of Offshore Business Formation Unknown Facts About Offshore Business FormationThe Offshore Business Formation StatementsOffshore Business Formation for DummiesTop Guidelines Of Offshore Business Formation

If you registered a company in Hong Kong, its income would only be taxed from 8. The income that is earned outside of Hong Kong can be completely spared from neighborhood tax obligation. Apple, Samsung, Google, Berkshire Hathaway, they all have actually developed overseas business as their subsidiaries in numerous countries all over the globe.

The Basic Principles Of Offshore Business Formation

Other common advantages consist of better personal privacy, possession protection, ease of incorporation, and also low-priced maintenance. Some nations enforce ridiculously high tax obligation rates on company earnings. Instance, The rates are 37. 5% in Puerto Rico, 30% in Germany, and also 25% in France That's why countless entrepreneurs available have made a decision to go offshore.

Tax optimization does not necessarily imply to escape tax obligations. Damaging the legislation is not a sensible thing to do. When seeking tax obligation solutions, you must abide by both the regulations in the incorporated jurisdiction and also your home country. You can browse on Google and also easily learn several places where the earnings tax obligation is a lot lower than your house nation.

Excitement About Offshore Business Formation

If you intend for the former group, you must take into consideration everything very carefully. Some no-tax territories are transforming their plans quick. They are beginning to enforce tax obligations as well as laws on particular sort of income and business activities. And some places have a really bad credibility in business world. These are the ones you ought to avoid. offshore business formation.

In particular, banks in Singapore or Hong Kong are really worried regarding opening an account for firms in tax obligation sanctuaries. The same goes with consumers and also clients. They would additionally be concerned to do company with your firm if it is included in such jurisdictions. The pressure most definitely gets on choosing the appropriate location.

Some Known Details About Offshore Business Formation

That's why thorough planning as well as study is a should (or at the very least the right appointment from the real experts). Example Below is an example for offshore preparation: You open up a company in the British Virgin Islands (BVI) to supply services overseas. You also develop your company's administration in another country to make it not a BVI-resident for tax functions.

And also because BVI has a fair online reputation, you can open a corporate financial institution account in Singapore. This will certainly permit your company to receive money from clients with convenience. If necessary, you then need to develop your tax obligation residency in an additional country where you can receive your company cash without being taxed.

The Only Guide to Offshore Business Formation

This indicates just the earnings produced from within these nations undergoes tax obligation (while foreign-sourced revenue is not). These nations normally have a network of worldwide tax treaties, which can bring you tax decrease as well as even exemption. These are a big plus besides their very little tax obligation prices. If you approve paying a small quantity of tax obligation in return for regard and also stability, low-tax territories can be the ideal choice.

This suggests, your possessions are protected versus the judgment made by foreign courts. Only the court of the consolidation jurisdiction can put a judgment on the possessions. As an example, if you formed a depend on in Belize, the count on's residential property would be shielded from any case according to the law of an additional jurisdiction.

Offshore Business Formation Can Be Fun For Anyone

Some other common offshore facilities that supply economic privacy are the BVI, Seychelles, Cayman Islands, and Nevis. The overseas unification process is rather straightforward and also quick.

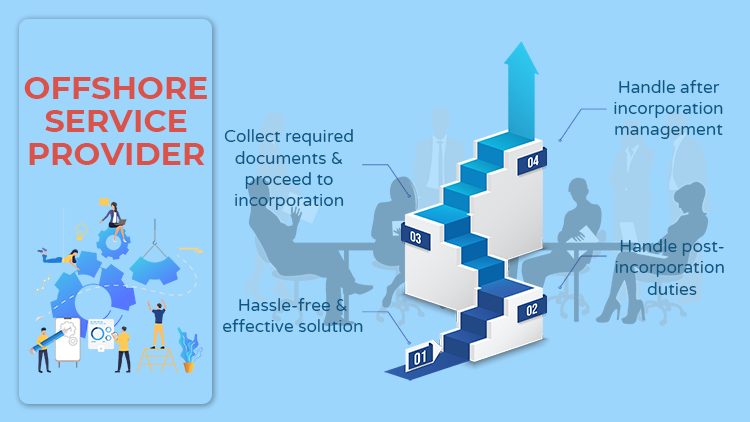

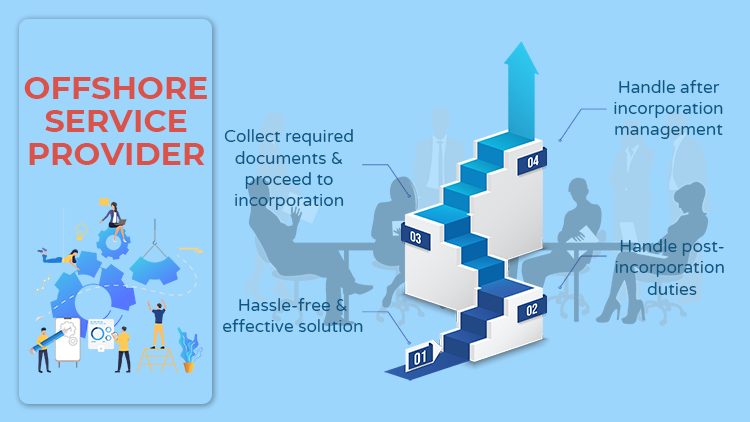

The consolidation requirements are generally extremely minimal. The very best thing is that several provider around can assist you with the enrollment. All you need to do is find a credible company, pay look at this now for solution, and supply needed files. They will certainly go on and also register the business on your part.

More About Offshore Business Formation

: Located in the western Caribbean Sea, this is an extremely typical selection for most foreign financiers that are looking for tax-free benefits.: BVI and also Cayman Islands share many common functions - offshore business formation. Yet an and also is that the unification cost in the BVI tends to be far more inexpensive than that in the Cayman Islands.

Here is the basic incorporation process. Please note that things might get somewhat different according to various territories. There are lots of different types of company entities. address Each type will bear different key characteristics. When choosing your kind of entity, you must take into consideration the adhering to facets: The entity lawful condition The liability of the entity The tax and various other advantages of the entity Suggestion, The guidance is to go for the kind of firm that has a different legal status.

Offshore Business Formation Things To Know Before You Buy

A different legal entity guarantees you a high level of security. Each jurisdiction has a various set of needs as well as consolidation process.

8 Simple Techniques For Offshore Business Formation

The reason is that foreigners do not have certain tools and also accounts to register on their own. Also when it is not required, you are still suggested to make use of Your Domain Name an unification solution.